- CHASE INTERNATIONAL WIRE TRANSFER FEE HOW TO

- CHASE INTERNATIONAL WIRE TRANSFER FEE CODE

- CHASE INTERNATIONAL WIRE TRANSFER FEE PROFESSIONAL

CHASE INTERNATIONAL WIRE TRANSFER FEE PROFESSIONAL

The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication.

Otherwise, contact your bank directly to ask for the SWIFT code.

CHASE INTERNATIONAL WIRE TRANSFER FEE CODE

You can copy and save the Chase international wire transfer SWIFT code shown above, view it online or in the Chase app. No matter the type of wire, there’s always a sending and receiving party and an entity in the middle facilitating the transfer. Today, wire transfers happen in a wide variety of ways beyond the telegraph wires of yesteryear. How Long Do International Wire Transfers Take to Reach the Recipient? Wire transfers within the US take less than 24 hours, while international transfers can take up to five days. Delivering a personal approach to banking, we strive to identify financial solutions to fit your individual needs. provides information to clients about their accounts and financial services by First Republic Bank and its affiliates. Chase provides step-by-step instructions for hassle-free money transfers.īy selecting your state of residence, you’ll be shown the specific terms and rates that will apply to your new account. However, keep in mind that Chase has a wire cut-off time of 4 pm EST, so if your request is submitted after that point it won’t be processed until the following business day. You can contact your sender to let him know that you still haven’t received the money in your Indian bank account so he can make a follow up on the transfer status with Chase. Traditionally, a wire transfer of money goes from the first bank to the second through different networks. A wire transfer is the process of transferring money between two banks through electronic means. Regardless of the amount involved, the recipient receives the fund almost immediately.

CHASE INTERNATIONAL WIRE TRANSFER FEE HOW TO

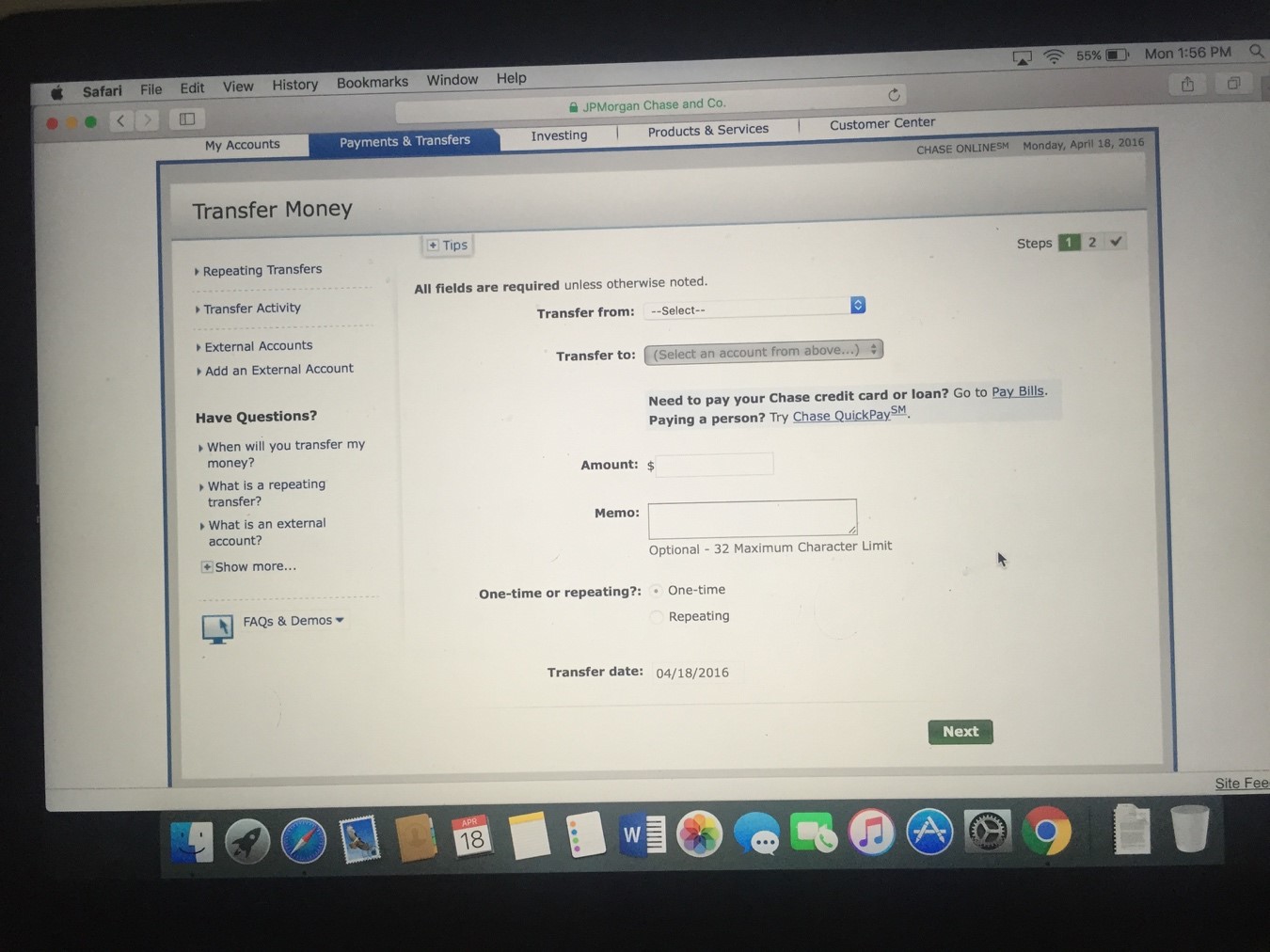

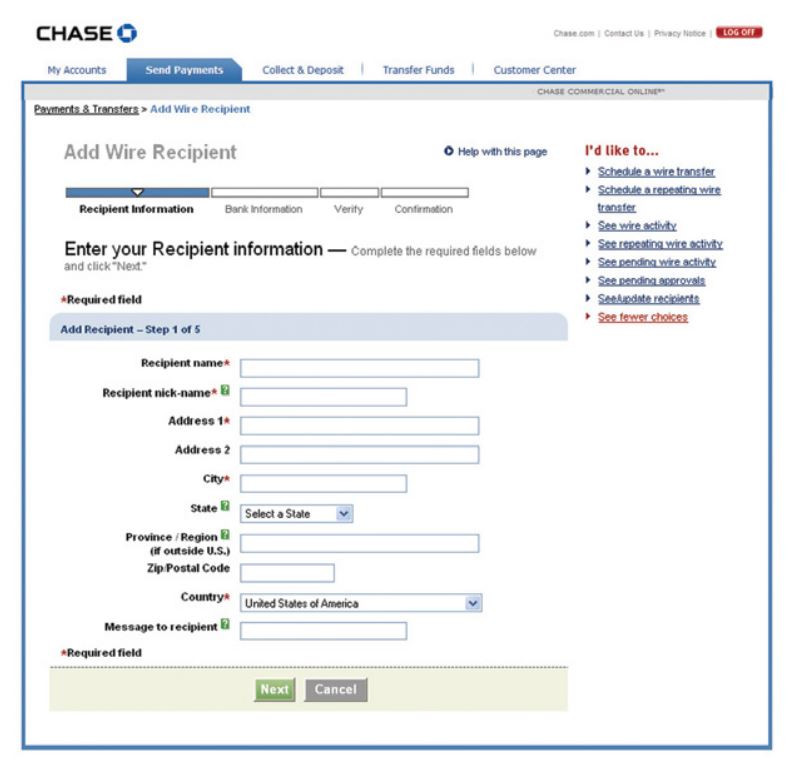

How to do a Chase bank wire transfer instructionsĪgain, wire transfer would be your only option of money transfer when the amount to be transferred is pretty substantial.Sign on to get started Take the tour Compare your options and fees.How Long Do International Wire Transfers Take to Reach the Recipient?.

0 kommentar(er)

0 kommentar(er)